Turn Transfer Pricing Complexity into Strategic Advantage

You juggle audits, data silos, and shifting regulations. Tax.com’s transfer pricing solutions help you streamline compliance, eliminate manual work, and deliver insights that elevate your role from reactive to strategic.

See tax.com in Action

Trusted by Global Leaders

Trusted by the World’s Leading Multinationals.

Built by tax experts and backed by Ryan, tax.com is trusted by Fortune 500 companies to transform their transfer pricing chaos into a strategic differentiator.

Built for the Challenges You Face

Transfer Pricing Is Complex—Let's Make It Easier

Automate compliance with OECD BEPS, Pillar One & Two, and local tax laws.

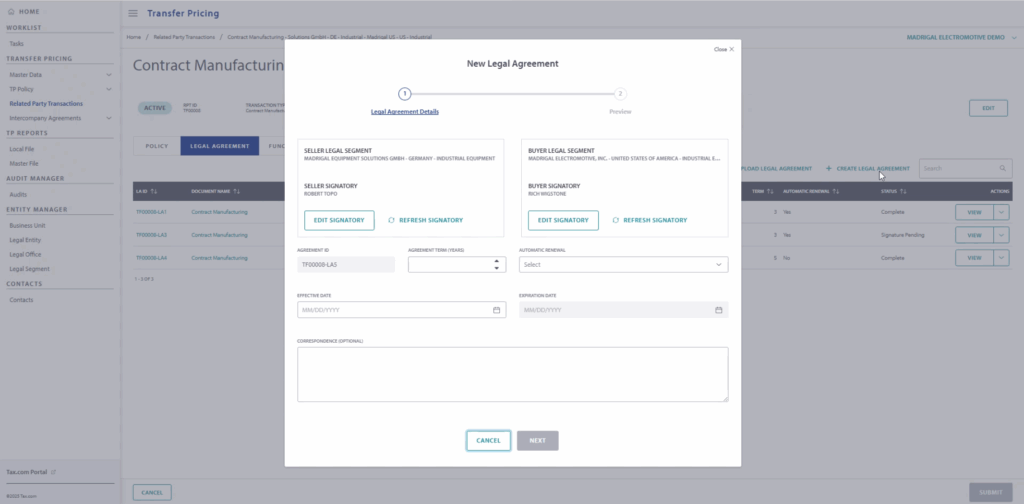

Centralize documentation and track intercompany transactions with full audit trails.

Integrate with ERP and tax systems to automate data collection, benchmarking, and reporting.

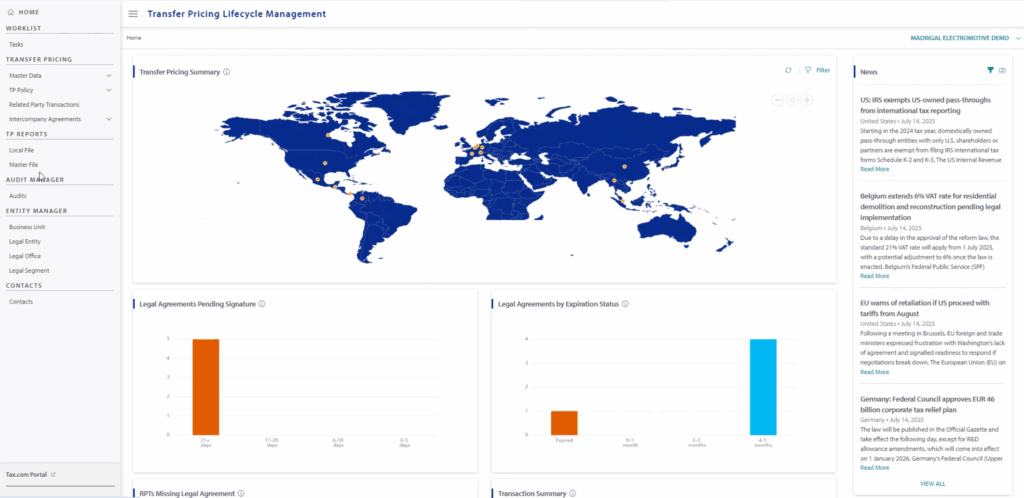

Real-Time Monitoring

Real-Time Visibility into Intercompany Transactions.

Monitor pricing, flag risks, and ensure alignment with your transfer pricing policy before issues arise.

Why Choose tax.com

Why Transfer Pricing Leaders Choose tax.com

Expert-Backed Technology

Scalable for Growth

Seamless ERP Integration

Global Compliance Coverage

Audit-Ready Documentation

Automate Master File, Local File, & CbCR

Generate jurisdiction-specific documentation with built-in benchmarking and collaborative workflows.

Trusted by Transfer Pricing Professionals

TP Documenter has been a game-changer throughout my 13+ years in the industry. Its simple framework makes documentation a breeze, even for complex structures. The comparable company benchmarking is one of the best, and it's only gotten better over time.

I now have multiple team members using the tool efficiently, and the ability to leverage modules and update reports year over year is invaluable. I've seen a lot of transfer pricing tools come and go, but this one has stood the test of time. If you're serious about streamlining your transfer pricing documentation, this is the tool for you.

See how our platform fits your compliance needs.

Our experts guide you through setup and integration.

Automate documentation, reduce risk, and gain control.

See tax.com’s Transfer Pricing Solution in Action

Schedule a personalized demo and discover how we help you automate compliance, reduce audit risk, and align transfer pricing with business strategy.