Transfer Pricing Documenter™

End-to-End Solution That Centralizes Transfer Pricing Documentation and Benchmarking Obligations

Access global, comparable third-party databases and streamline the entire transfer pricing compliance process.

Key Features

A centralized, cloud-based solution, Transfer Pricing Documenter increases accuracy, efficiency, and consistency of annual reporting, mitigating risk of penalties and adjustments. Robust, comprehensive third-party data and roll-forward capabilities streamline the creation of studies and reports.

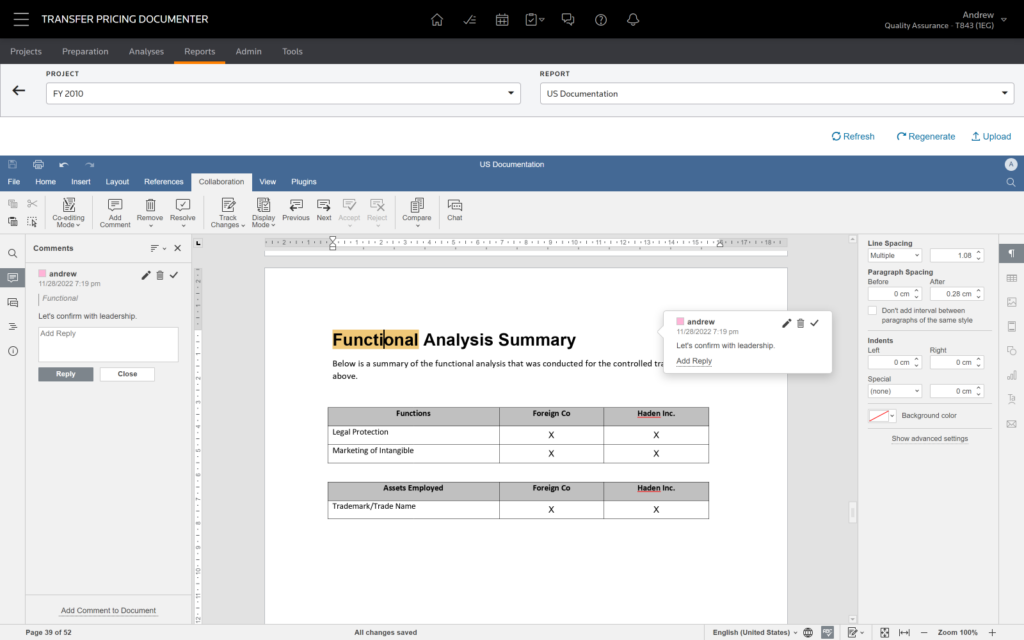

- Rich document creation

- Multi-user collaboration

- Live dashboard

- Automatic imports

- Intuitive search capabilities

- Global comparable data

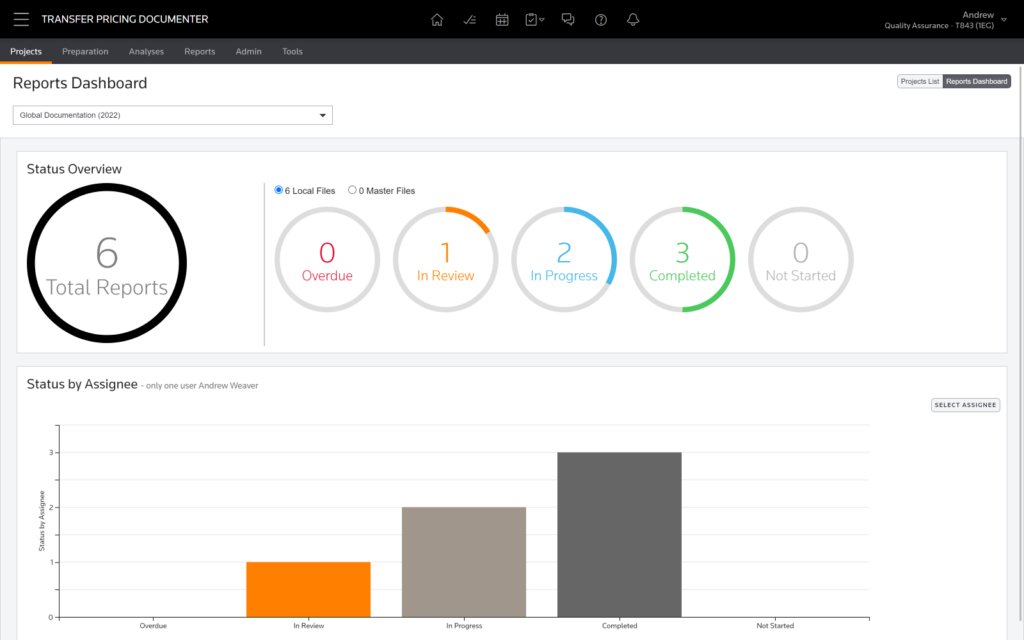

Reports Dashboard

Check the status of global documentation for a given year.

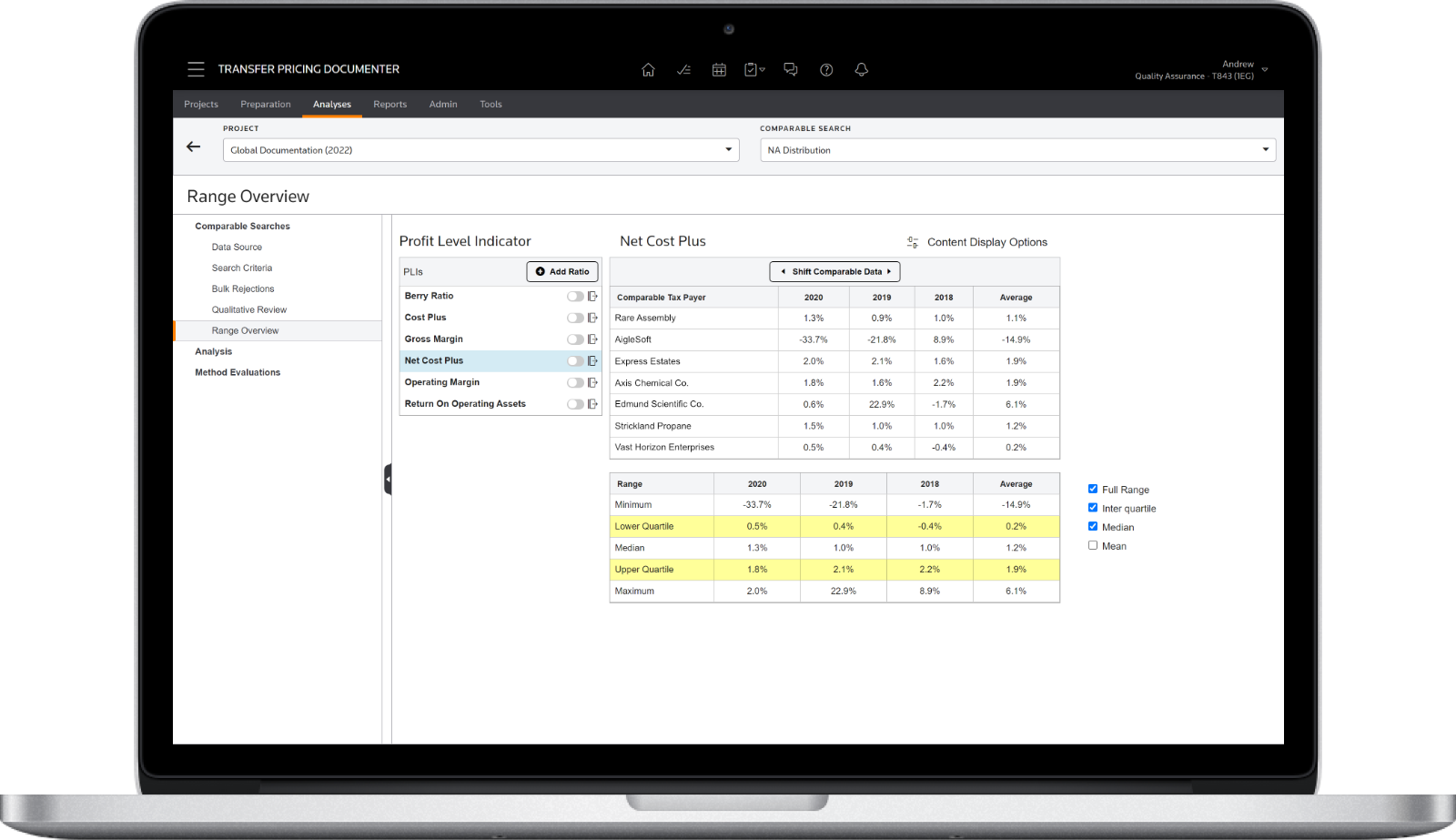

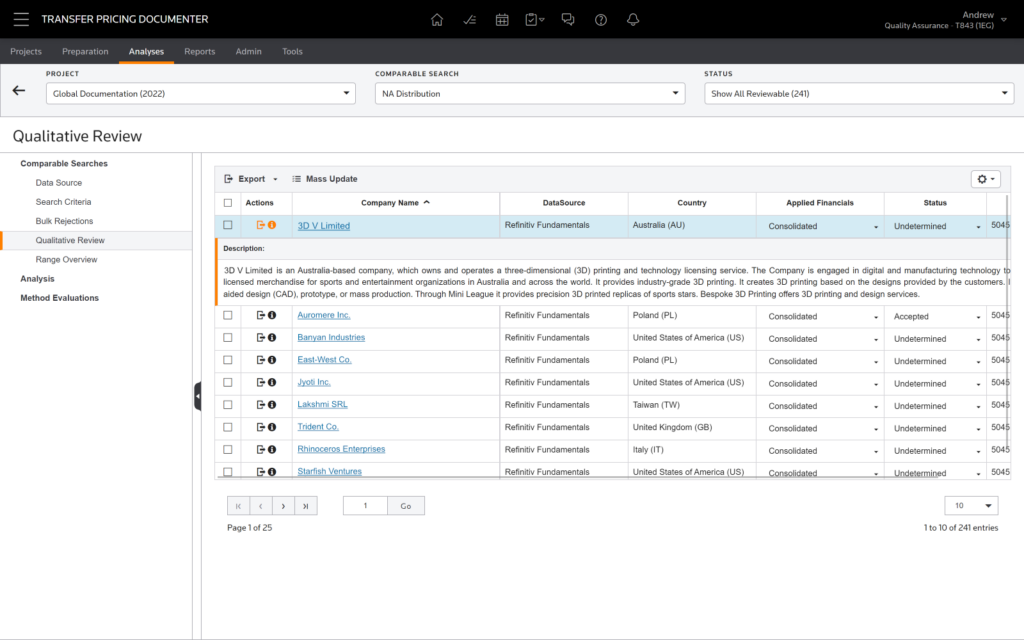

Benchmarking

Follow a guided approach to analyze intercompany results and obtain reliable third-party data.

Report Layout

Fully customize reporting with comprehensive design and collaborative tools.

Differentiators

Transfer Pricing Documenter is backed by experienced practitioners.

- Chosen by some of the world’s largest multinationals to comply with global taxation requirements

- State-of-the-art technology with time-saving import, search, and reporting functions

- One-click report rollforward for year-over-year efficiency and minimal rework

- Access to millions of public and private comparable company databases

- Annually updated transfer pricing regulatory environment write-ups for more than 70 countries

- Support services include transfer pricing process design and software implementation

Related Products That May Interest You

Transfer Pricing Operational™

Innovative global tax reporting solution for intercompany transactions

Optimus™

The Premier Software Solution for Global Property Tax Management, Assessments, and Appeals

Request a Demo

Take a closer look at our robust solutions with one of our team members.