Transfer Pricing Lifecycle Management™

Comprehensive Solution for Transfer Pricing Management from Planning to Controversy Support.

Drive tax savings, reduce compliance risk, and mitigate penalty risk by centralizing and automating your Transfer Pricing Lifecycle Management (TPLM) ™.

Key Features

Transformative solution to address growing transfer pricing risks

- Efficiency & Compliance Increase productivity and reduce time spent on compliance activities

- Strategic Enablement Real-time insights on your TP global landscape

- Future-Proofing the Function Automating compliance tasks

- Audit Readiness Mitigate risk of audit and penalties

- Centralization & Visibility Central repository of all TP data and documentation providing actionable insights

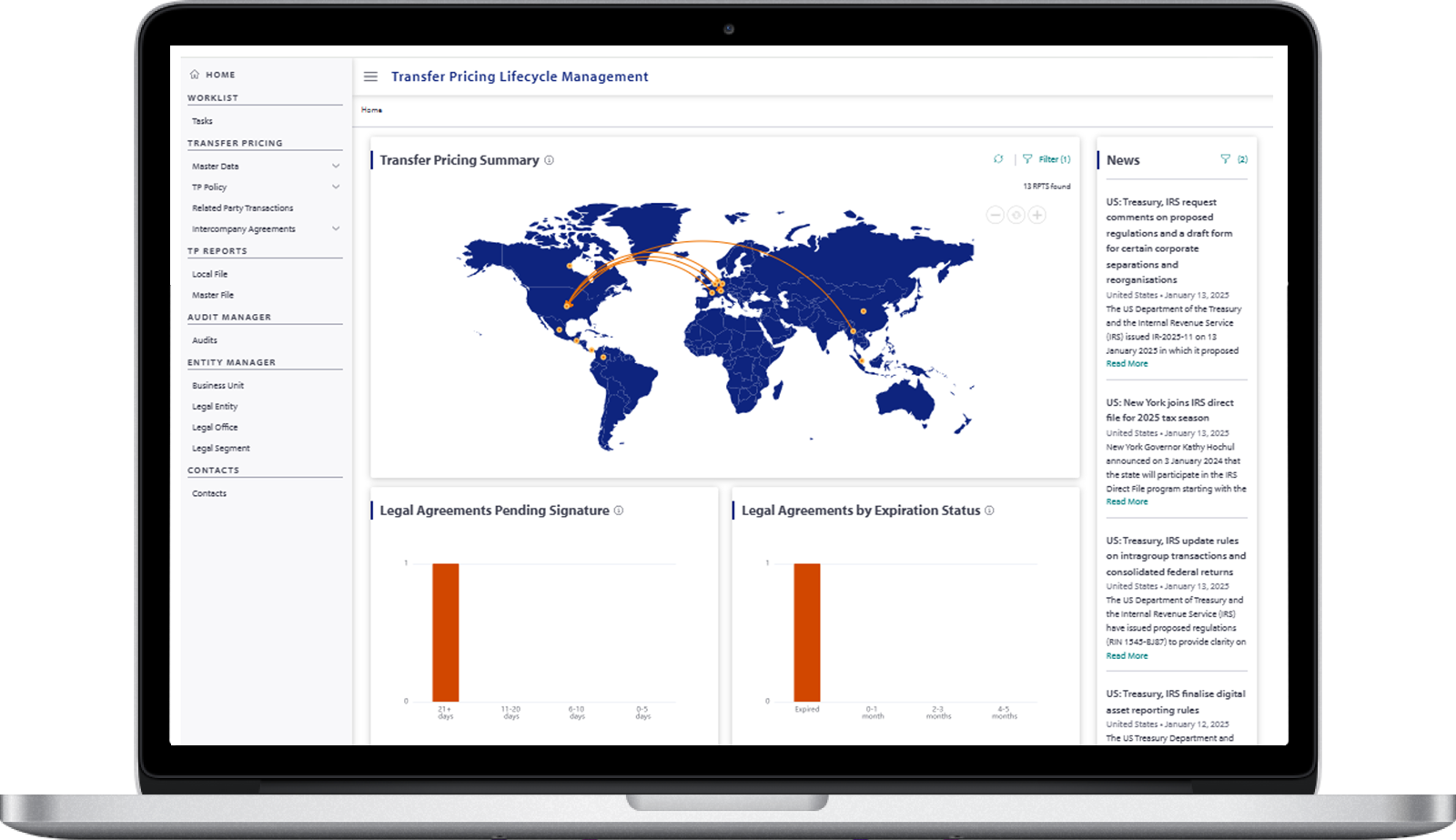

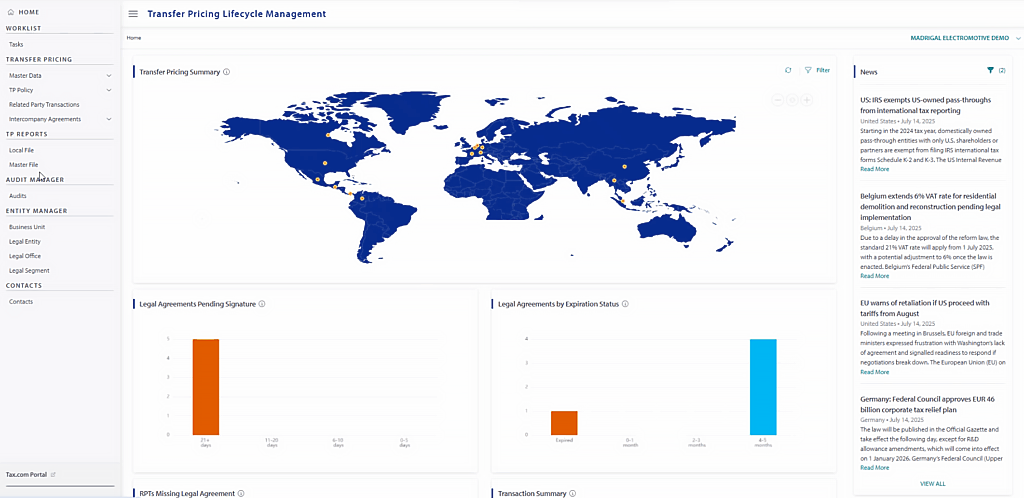

Dashboard

Stay ahead of compliance with the TPLM dashboard: visualize global operations, track agreement coverage and audits in real time, and access curated tax news tailored to every country where you operate.

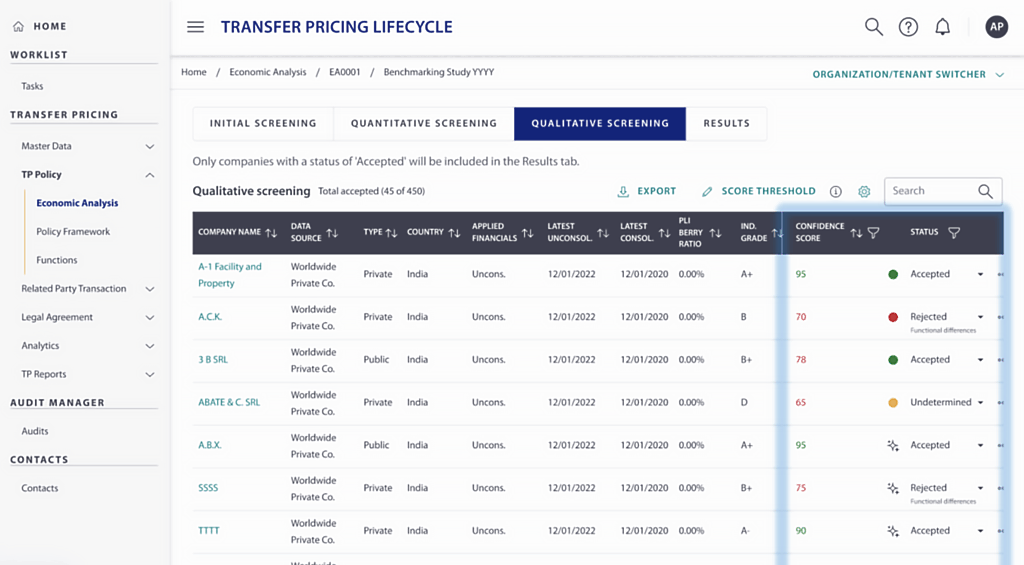

AI Benchmarking

AI Benchmarking accelerates transfer pricing studies by pre-populating the right industry codes and auto-screening comparables—cutting days of manual review down to just minutes.

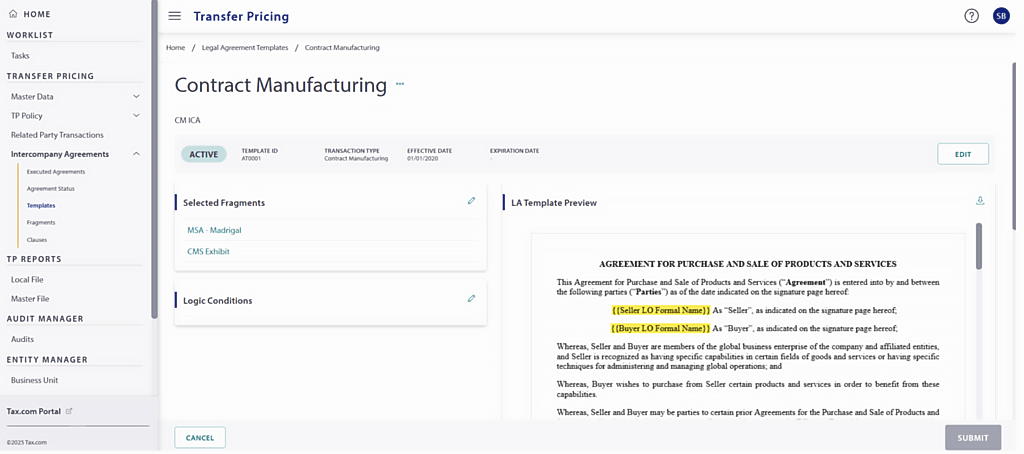

Intercompany Agreements

Intercompany agreements are auto-generated with policy data pre-filled, using templates and variables to cut drafting, execution, and management time by half—while keeping every document accurate and compliant.

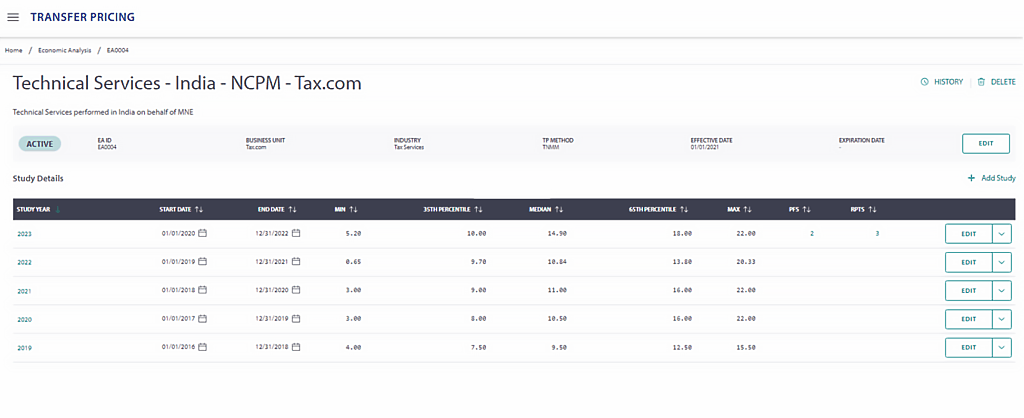

Economic Analysis

Economic Analysis keeps your transfer pricing data audit-ready and compliant—automating updates so your documentation stays consistent and effortless to maintain.