Transfer Pricing Operational™

Innovative Global Tax Reporting Solution for Intercompany Transactions

Gain perspective and control with a complete view of multinational intercompany pricing and global tax reporting.

Key Features

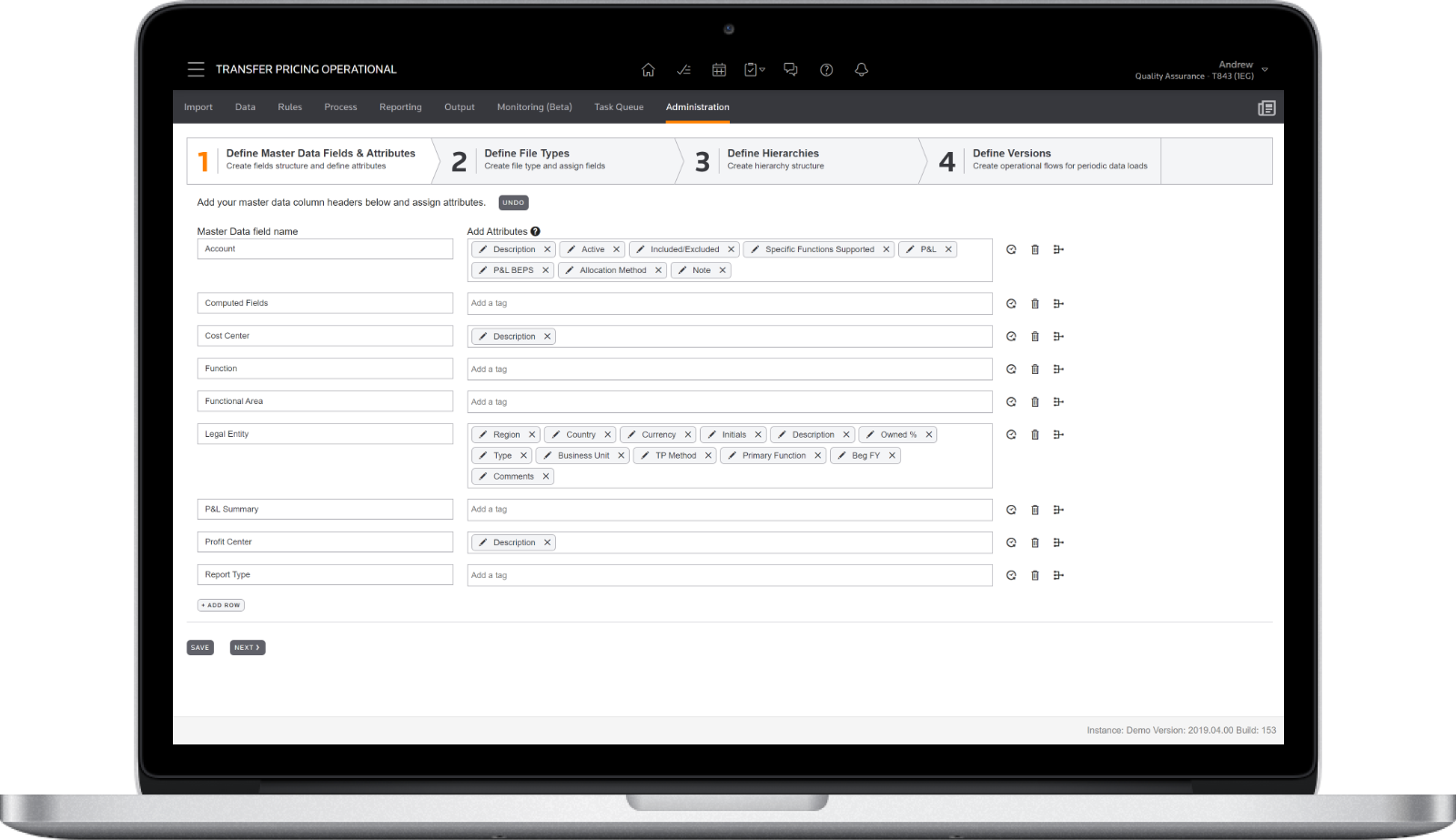

Transfer Pricing Operational centralizes and automates internal data collection, validation, and standardization. Powerful end-to-end reporting provides increased transparency, accuracy, and control. Automate intercompany price adjustments and segment data for profit and loss analysis.

- Complete process from data collection, transformation, rules and allocations, adjustments, journal entries, and invoicing

- Macro and micro views to check accuracy of reporting results

- Strong audit defense with access to granular details and data traceability from input to output

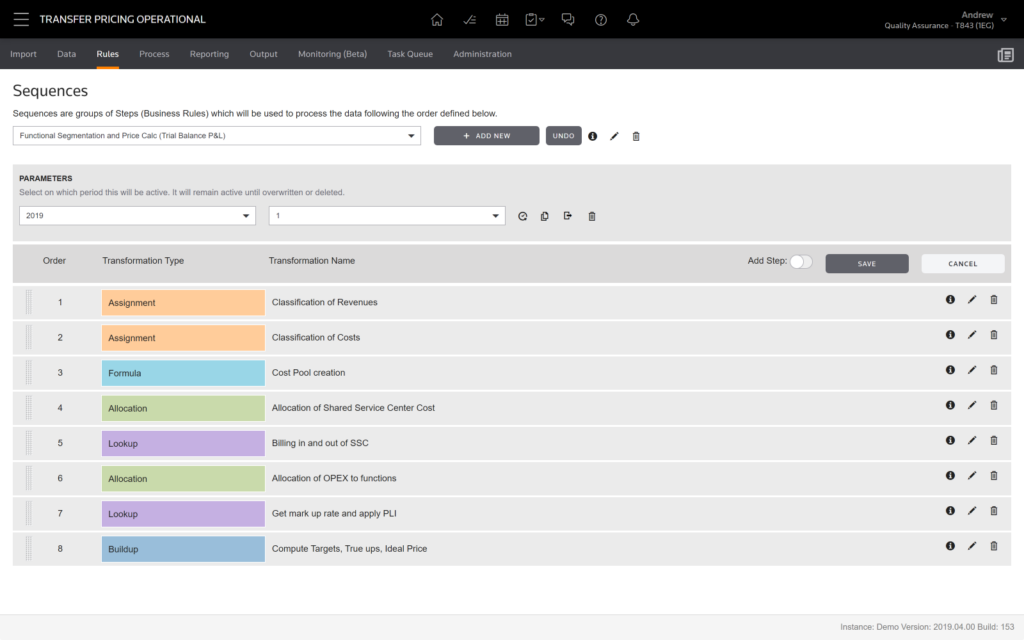

Sequence

View different, color-coded rules and dig in deeper.

Differentiators

Transfer Pricing Operational is backed by experienced practitioners.

- Longest established transfer pricing solution adopted by some of the world’s largest multinational corporations

- Industry standard data sources and global coverage

- World-class user controls and security

- Scalable to meet the needs of the largest multinational corporations

Related Products That May Interest You

Transfer Pricing Documenter™

End-to-End Solution That Centralizes Transfer Pricing Documentation and Benchmarking Obligations

Optimus™

The Premier Software Solution for Global Property Tax Management, Assessments, and Appeals

Request a Demo

Take a closer look at our robust solutions with one of our team members.